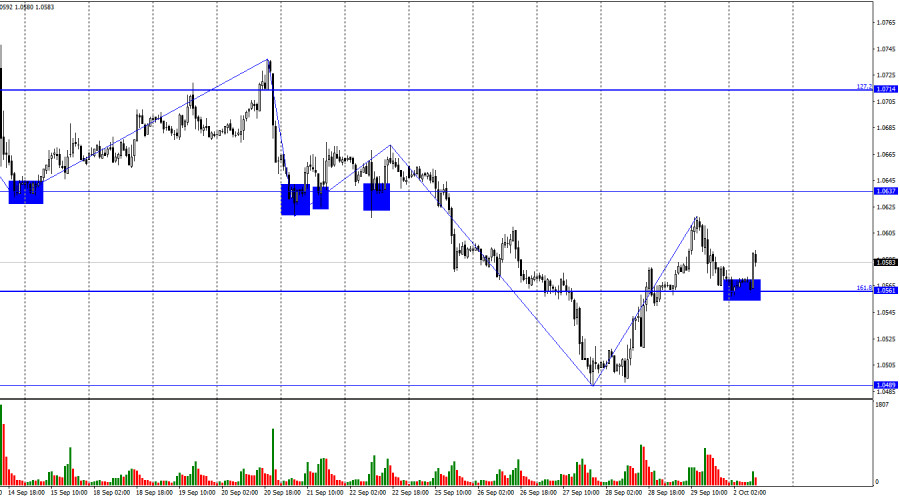

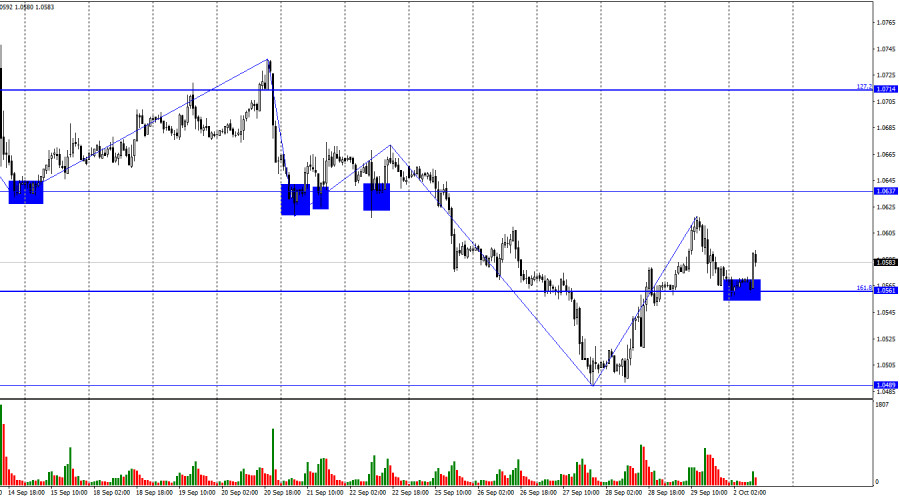

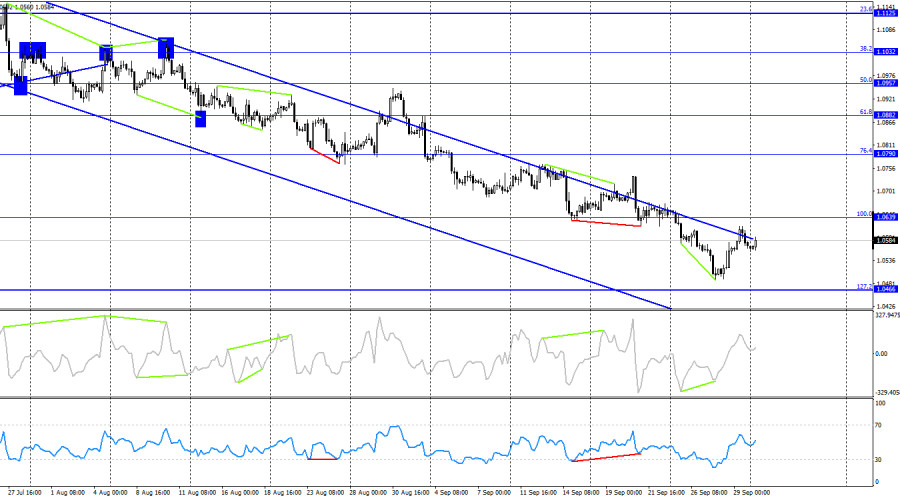

On Friday, the EUR/USD pair managed to close above the corrective level of 161.8% (1.0561) and rose towards the level of 1.0637. However, in the second half of the day, there was a reversal in favor of the US dollar, and the pair returned to the 1.0561 level. A rebound from this level on Monday allows traders to anticipate a reversal in favor of the euro and new growth towards the level of 1.0637. A sustained break below the 1.0561 level would allow us to expect a resumption of the decline towards the level of 1.0489.

Despite the formation of a strong upward wave on Thursday and Friday, it did not change anything in the overall picture because the preceding downward wave was even larger. However, the latest downward wave (formed on Friday) still provides some grounds to expect the end of the bearish trend. If this wave ends around 1.0561, the low of the previous downward wave will remain unbroken. If the next upward wave breaks the Friday peak, it will be the second sign of a transition to a bullish trend.

Friday's news background was not the strongest, but it was quite rich because there were plenty of reports. In the first half of the day, an important report on inflation in the European Union was released, showing a slowdown to 4.3% y/y. No one among traders had expected such a figure. Bullish traders were pleased with positive data on the European economy, which helped the euro rise a little more. However, in the second half of the day, the dollar started to rise, even though economic reports from the United States were quite weak in all respects. Personal income and spending increased by 0.4% m/m, as expected. The core Personal Consumption Expenditures (PCE) Price Index rose by 0.1% compared to expectations of 0.2%. The Consumer Sentiment Index fell to 68.1 from 69.5. US economic statistics were supposed to put more pressure on the dollar than provide support.

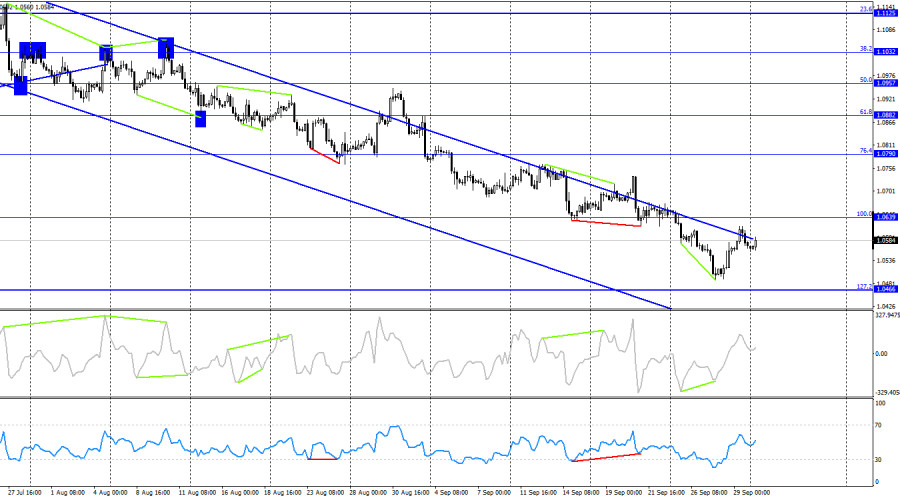

On the 4-hour chart, the pair reversed in favor of the euro after forming a bullish divergence on the CCI indicator. The growth process may continue towards the corrective level of 100.0% (1.0639). A rebound from this level or the upper boundary of the descending corridor will maintain the bearish trend and allow us to anticipate a resumption of the decline towards the corrective level of 127.2% (1.0466). A close above the 1.0639 level with a high degree of probability will indicate the end of the bearish trend.

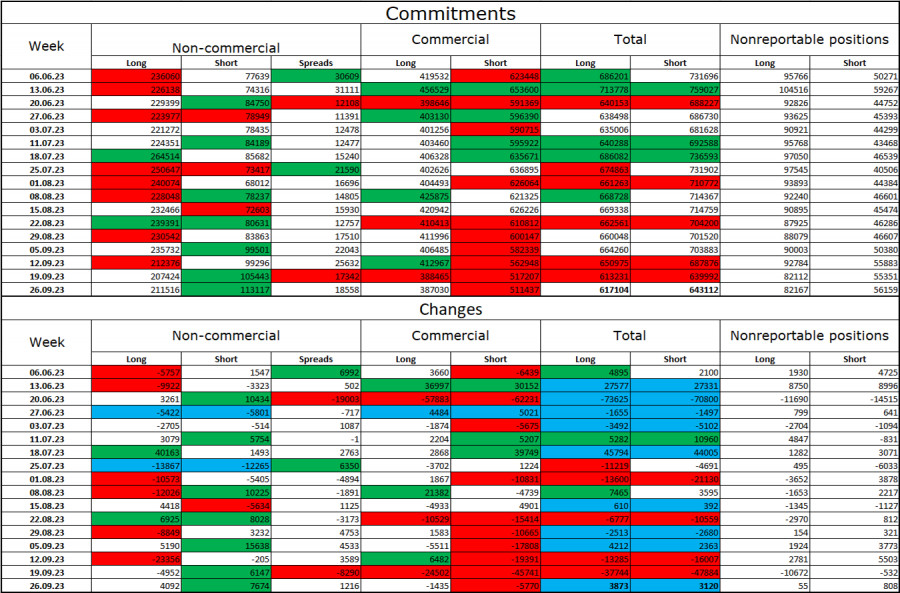

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 4,092 long contracts and 7,674 short contracts. The sentiment of major traders remains bullish but has noticeably weakened in recent weeks and months. The total number of long contracts concentrated in speculators' hands now stands at 211,000, while short contracts amount to 113,000. The gap is now only two-fold, whereas a few months ago, it was three-fold. I believe that the situation will continue to change in favor of bears over time. Bulls have dominated the market for too long, and now they need strong news flow to sustain the bullish trend. Such a backdrop is currently lacking. The high value of open long contracts suggests that professional traders may continue to close them in the near future. I believe that the current numbers allow for further declines in the euro in the coming months.

Economic Calendar for the United States and the European Union:

European Union - Germany's Purchasing Managers' Index (PMI) for the manufacturing sector (07:55 UTC).

European Union - Purchasing Managers' Index (PMI) for the manufacturing sector (08:00 UTC).

United States - Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI) (14:00 UTC).

United States - Speech by Federal Reserve Chairman Mr. Powell (15:00 UTC).

On October 2nd, the economic calendar includes several interesting events, with Jerome Powell's speech and the ISM index standing out. The impact of the news background on traders' sentiment today may be of moderate strength.

Forecast for EUR/USD and trader recommendations:

Sales of the pair are possible today if it consolidates below the level of 1.0561 on the hourly chart, with targets at 1.0489. As for buying today, we are already a bit late, but a rebound from the level of 1.0561 allows for opening small long positions with targets at 1.0615 and 1.0637.