Trade Analysis and Tips for Trading the British Pound

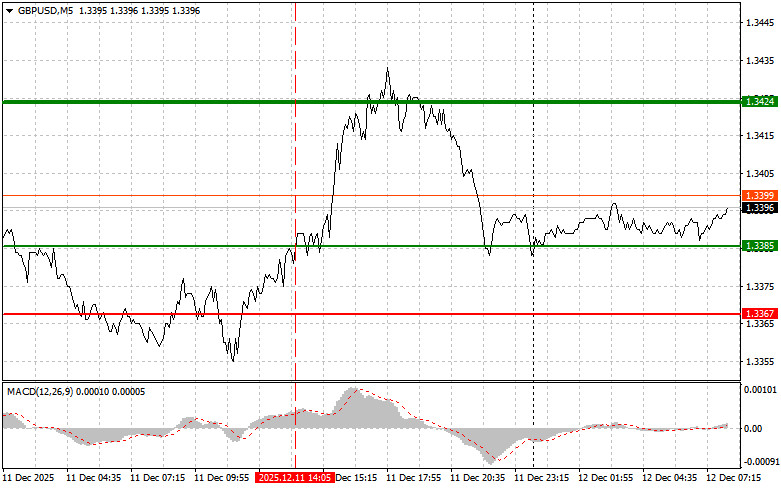

The test of the price level at 1.3385 occurred when the MACD indicator had moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy the pound and missed out on all the upward movement.

News that the weekly number of initial jobless claims in the United States was higher than expected led to a decline in the dollar and a rise in the British pound in the afternoon. The US labor market continues to show signs of cooling, which increases investors' expectations regarding further easing of monetary policy by the Federal Reserve. This factor puts pressure on the dollar, making it less attractive to investors seeking higher returns in other currencies.

Today, the United Kingdom will release its GDP data, industrial output, and goods trade balance. GDP, as a cornerstone of the economy, will allow for an assessment of the pace of economic expansion or, conversely, contraction, which is necessary for determining the country's future development path. Given that the last positive GDP growth data was published only in July of this year, any negative figures today could exert much more pressure on the pound than may be apparent. The dynamics of industrial production represent another important indicator, reflecting the state of the industrial sector, which plays a significant role in GDP formation and employment. An increase in industrial production indicates rising consumer demand for goods and services, forming the basis for further economic growth. A decline, on the other hand, suggests a slowdown in economic activity and can serve as a harbinger of more serious economic problems.

The trade balance of goods, in turn, shows the difference between exports and imports. Together, these three economic indicators will provide a comprehensive picture of the current state of the British economy and allow market participants and investors to make more informed decisions.

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

Buy Scenarios

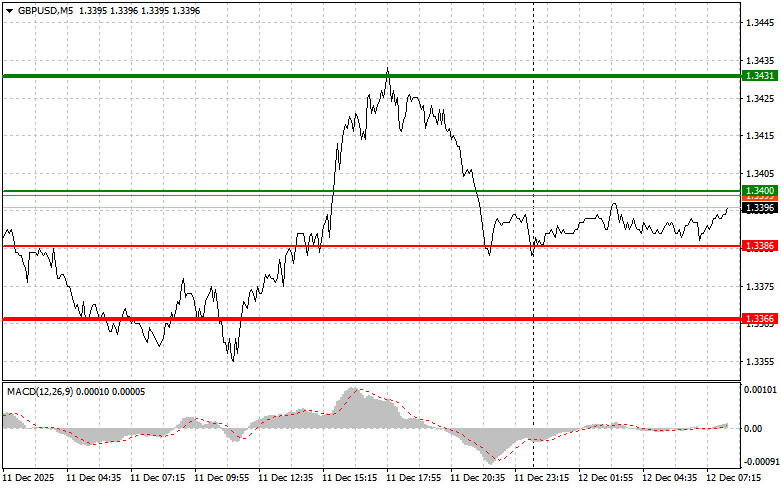

Scenario #1: I plan to buy the pound today when it reaches the entry point around 1.3400 (green line on the chart), with a target of 1.3431 (thicker green line on the chart). At the 1.3431 level, I plan to exit my long positions and open short positions in the opposite direction (anticipating a move of 30-35 pips back from that level). Expecting strong pound growth can only be done after good data. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting its climb from there.

Scenario #2: I also plan to buy the pound today if the price level at 1.3386 is tested twice consecutively while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise towards opposite levels of 1.3400 and 1.3431 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the pound today after it breaks the 1.3386 level (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3366 level, where I intend to exit my shorts and immediately open longs in the opposite direction (anticipating a 20-25-pip move back from that level). Pound sellers will show their strength if weak data emerge. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the pound today if two consecutive tests of the 1.3400 price level occur while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline towards opposite levels of 1.3386 and 1.3366 can be anticipated.

What's on the Chart:

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or take profit yourself, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or take profit yourself, as further decline below this level is unlikely;

- MACD Indicator. When entering the market, it is essential to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.