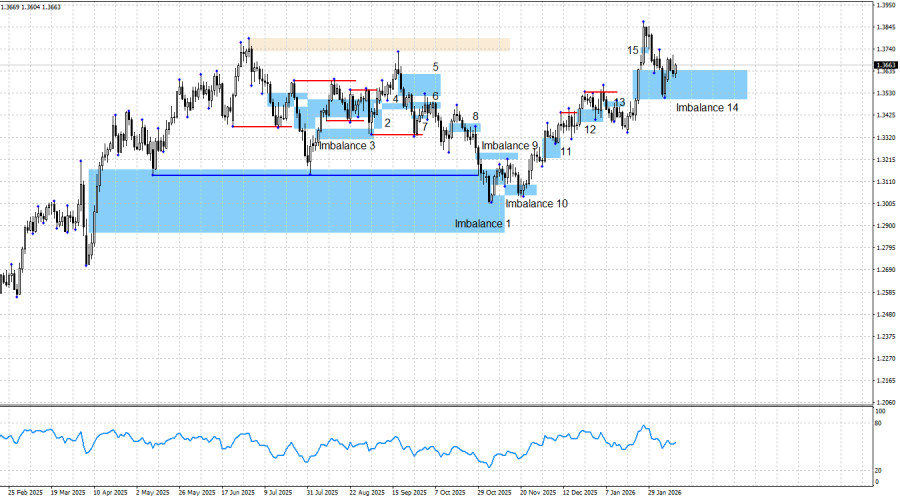

The GBP/USD pair fully filled the last bullish imbalance, receiving a reaction at its lower boundary. Thus, a bullish signal has formed for the pound as well, just as I expected. Most importantly, buy signals were formed almost simultaneously for both the pound and the euro. This significantly increases the likelihood of further growth in both currency pairs.

At present, new trades have been opened, and the news background does not hinder bullish traders. The U.S. labor market remains weak, and U.S. policy continues to create uncertainty both domestically and internationally. There are currently no bearish patterns, nor are there clear conditions for them to form. Bearish patterns require specific catalysts and active selling pressure, which are not present in the market at this time.

The unemployment rate in the U.S. has declined, which is a positive development. However, the revision of the 2025 labor market data offset the recent gains in the U.S. dollar. In my view, dollar buyers (who are bears on GBP/USD and EUR/USD) are currently absent from the market. Only the bulls are trading. If they increase positions, the pair rises. If they take profits, the pair declines. That's the entire mechanics of the movement.

The bullish trend for the pound remains intact, as confirmed by the chart structure. Since November 5 alone, traders have had at least three opportunities to open long positions, and this week they received a fourth. Bullish signals are forming regularly, while bearish patterns have not been seen for quite some time. In my opinion, this is a case where there is no need to reinvent the wheel. There are currently no signs of a bearish offensive. I see no reason to consider short trades.

On Thursday, the news background initially supported the U.S. dollar during the first half of the day. However, as mentioned earlier, the bears are absent from the market, so there is no one to buy the dollar. The market also showed no desire to sell the pound, despite weak UK economic growth and even more disappointing industrial production data. Slowly but surely, the dollar continues to sink—to Donald Trump's apparent satisfaction.

This week, only the inflation report remains, which could put additional pressure on the U.S. currency. If inflation slows as traders expect, it will provide yet another reason to sell the dollar as quickly as possible.

In the U.S., the overall news environment suggests that, in the long term, the dollar is more likely to weaken than strengthen. The situation in the U.S. remains quite complex. U.S. labor market statistics continue to disappoint more often than they encourage. Three of the last four FOMC meetings have ended with dovish decisions. Trump's military aggression, threats toward Denmark, Mexico, Cuba, Colombia, Iran, EU countries, Canada, and South Korea, the criminal case initiated against Jerome Powell, a new "shutdown," and the scandal involving U.S. elites in the Epstein case all further illustrate the current political and structural crisis in the country. In my view, the bulls have everything they need to continue their offensive throughout 2026.

A bearish trend would require a strong and stable positive news background for the U.S. dollar—something difficult to expect under Donald Trump. Moreover, the U.S. president himself does not need a strong dollar, as it would keep the trade balance in deficit. Therefore, I still do not believe in a bearish trend for the pound. Too many risk factors continue to weigh heavily on the dollar. If new bearish patterns emerge, a potential decline in the pound can be considered, but at the moment there are none.

News calendar for the U.S. and the U.K.:

U.S. – Consumer Price Index (13:30 UTC).

On February 13, the economic calendar contains only one entry, but it is an important one. The impact of the news background on market sentiment on Friday will be present, particularly in the second half of the day.

GBP/USD forecast and trading advice:

The picture for the pound remains bullish. A new buy signal has formed and has not been invalidated. The bulls have launched a new offensive, which threatens to become prolonged and exhausting. They are not planning a rapid advance. Why rush if the dollar can be sold gradually? Since the bullish trend raises no doubts, traders are left with buying on clear patterns and signals. Imbalance 14, as expected, provided such an opportunity.

As a potential upward target, I considered the 1.3725 level, which has already been reached, but the pound could rise much higher in 2026. There are no limits. The next attractive target appears to be 1.4246—the June 2021 high.