Volatility Returns to the Scene

US Stock Markets Close Slightly Lower as Investors Look for Economic Signals

US stock markets closed slightly lower on Thursday after a choppy session that saw gains and losses. Investors were trying to make sense of the latest macroeconomic data and the tone of the Federal Reserve's statement, which was laced with concerns about trade barriers.

Sentiment is growing cautious

The mood on Wall Street has worsened markedly in recent weeks, amid a string of data that point to a possible slowdown in economic growth and a decline in consumer optimism. All this is happening against the backdrop of an ongoing trade standoff that has unfolded after Washington imposed new tariffs in response.

Hopes for policy easing

Despite this, stocks have risen in three of the previous four trading sessions. The rally was particularly strong on Wednesday, with the S&P 500 gaining more than 1% after the Fed kept its key interest rate unchanged. The regulator also confirmed its intention to cut rates twice before the end of the year, each time by 0.25%, in line with its forecast three months ago.

The central bank also noted in its speech that it expects weaker economic growth and, at least temporarily, higher inflation. This leaves room for maneuver in monetary policy.

Numbers of the day

Key indices ended the day in the red.

- The Dow Jones Industrial Average fell by 11.31 points, or 0.03%, to close at 41,953.32;

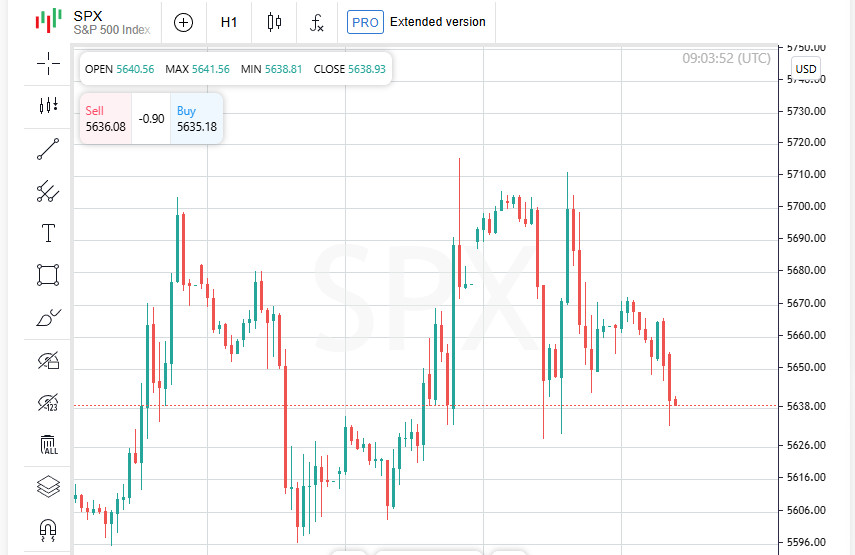

- The S&P 500 lost 12.40 points, or 0.22%, to close at 5,662.89;

- The Nasdaq Composite fell by 59.16 points, or 0.33%, to close at 17,691.63.

Alarm bells ringing: Labor market and economic benchmarks

The latest data from the U.S. labor market has given investors something to think about: the number of initial jobless claims increased slightly last week. While the increase is not dramatic, when combined with other factors — cuts in government spending, high borrowing costs, and political turbulence — it paints a bleak picture.

Meanwhile, the Conference Board reported a decline in its index of leading economic indicators: the indicator fell 0.3% in February after falling 0.2% in January. This is the second month in a row that the indicator has moved lower, indicating a possible slowdown in growth.

Rate expectations: bet on a decline

The market is increasingly counting on the Federal Reserve to ease monetary policy this year. According to the LSEG platform, current expectations imply a 63 basis point rate cut by 2025, with a 71% chance of the first 25 basis point cut as early as June.

Sector Breakdown: Technology Stalls, Oil Resurgent

Of the 11 major sectors in the S&P 500, technology has been the most vulnerable. The industry index has gone into negative territory, putting the greatest pressure on the entire market. At the same time, energy companies have shown growth: oil prices have jumped by almost 2% after the US introduced new sanctions against Iran. These actions have increased concerns about supplies, which has triggered an increase in prices for black gold.

Individual Stories: From Olive Garden to Accenture

Despite the general tension, there was room for pleasant surprises in the corporate sector. Shares of Darden Restaurants, which operates the Olive Garden chain, rose sharply - +5.77% in a day. The reason is the company's optimistic outlook, in which it indicated that trade tariffs would not have a significant impact on its business.

It was a different day for Accenture. The consulting giant's shares fell 7.26%, the sharpest one-day decline in a year. The company said the Trump administration's efforts to cut federal spending had led to the collapse of several government contracts, hurting its revenue and outlook.

Ray of Hope: Housing Market Supports Optimism

Fresh macroeconomic data from the US were mixed, but gave markets a reason for cautious optimism. The number of applications for unemployment benefits remained virtually unchanged, indicating stability in the labour market. However, an unexpected surprise was the growth in existing home sales, which exceeded analysts' forecasts and temporarily dispelled fears of an imminent economic slowdown, despite the cautious and lowered economic forecasts released by the Federal Reserve the day before.

Following the Fed: The Bank of England acts cautiously

Following the Federal Reserve's decision to keep rates unchanged, the Bank of England took a similar step. However, despite the pause in raising rates, the British regulator hastened to warn: one should not expect rates to be cut anytime soon. In the face of growing economic uncertainty, the Central Bank prefers to remain flexible and not rush into drastic measures.

Europe on its toes, but worried

Amid global turbulence, each of the European central banks has chosen its own strategy. The Swiss National Bank unexpectedly lowered its interest rate to almost zero, while admitting that Washington's trade policy is causing increasing concern.

The Swedish central bank, in turn, chose a wait-and-see approach, maintaining current rates and emphasizing its intention to act flexibly in response to external challenges.

But Turkey took a tough and immediate measure: against the backdrop of a sharp devaluation of the lira caused by the political crisis after the arrest of President Erdogan's main opponent, the regulator sharply increased the overnight rate to 46% in order to contain the currency panic.

Global imprint: markets under pressure

European financial markets responded to the wave of central bank decisions with a noticeable decline. Regulators across the continent are talking about a high degree of uncertainty, and the prospect of a new global trade war is increasingly putting pressure on investors.

- The MSCI Global Index fell 1.84 points, or 0.22%, to 843.53;

- The pan-European STOXX 600 Index fell 0.43%, reflecting growing pessimism;

- The broader FTSEurofirst 300 Index lost 9.08 points, or 0.41%, also falling into the red.

Emerging Markets Under Pressure

The decline was felt by key emerging market indices, with the MSCI Emerging Markets Index falling 3.16 points, or 0.28%, to 1,140.13.

At the same time, the broadest index of Asia-Pacific shares (excluding Japan) also ended in the red, down 0.14%, to close at 593.12.

The Japanese market also did not escape the decline: the Nikkei 225 index lost 93.54 points, or 0.25%, ending the trading day at 37,751.88. Pressure on the market is increased by both domestic concerns about slowing economic growth and global risks, including currency fluctuations and growing geopolitical instability.

Currency swings

The American currency strengthened amid expectations that the Federal Reserve is in no hurry to move towards easing monetary policy. The Fed's statements cooled investors' forecasts regarding an imminent rate cut, and the dollar immediately responded with growth.

The dollar index, which tracks the dynamics of the "greenback" against six major currencies, rose by 0.41%, reaching 103.80. The euro, in turn, fell by 0.44% and traded at $1.0853.

The dollar also gained slightly against the Japanese yen, up 0.06% to 148.77.

Bonds under control

The US Treasury bond market initially showed a decline, but yields began to reduce their decline in the second half of the session. Market participants adopted a wait-and-see attitude: uncertainty about future economic growth, coupled with monetary policy, makes investors cautious when placing capital in government securities.

Oil Fueled by Geopolitics

World oil prices have risen again. The growth was triggered by two factors at once: the introduction of new US sanctions related to Iran and the increased tensions in the Middle East. The threat of disruptions in energy supplies has once again come to the fore, and this has immediately affected the quotes.

Investors are increasingly betting on a scenario in which political risks become the dominant driver of the commodity market, especially in conditions where fundamental indicators remain under pressure.

American WTI crude oil has strengthened by 1.64%, reaching $68.26 per barrel. At the same time, the flagship global benchmark, North Sea Brent, has added 1.72%, ending the trading session at $72.00 per barrel.

The commodity market was supported by both the escalation of tensions in the Middle East and new US sanctions against Iran. These factors increased investors' concerns about the stability of supplies, and any potential disruptions are immediately reflected in price growth.

The precious metal is giving a signal

After an impressive leap, during which gold rewrote its historical maximum, quotes retreated slightly. Investors partially took profits, which caused a technical correction. Nevertheless, fundamental support for gold remains strong.

Spot gold fell by 0.07%, to $3,044.90 per ounce, while US gold futures, on the contrary, grew by 0.15%, reaching $3,040.60 per ounce.

There are many factors in favor of further growth: the soft stance of the Federal Reserve regarding future interest rates, increasing geopolitical turbulence and growing demand for a safe haven make gold an attractive asset for investors seeking to protect capital.